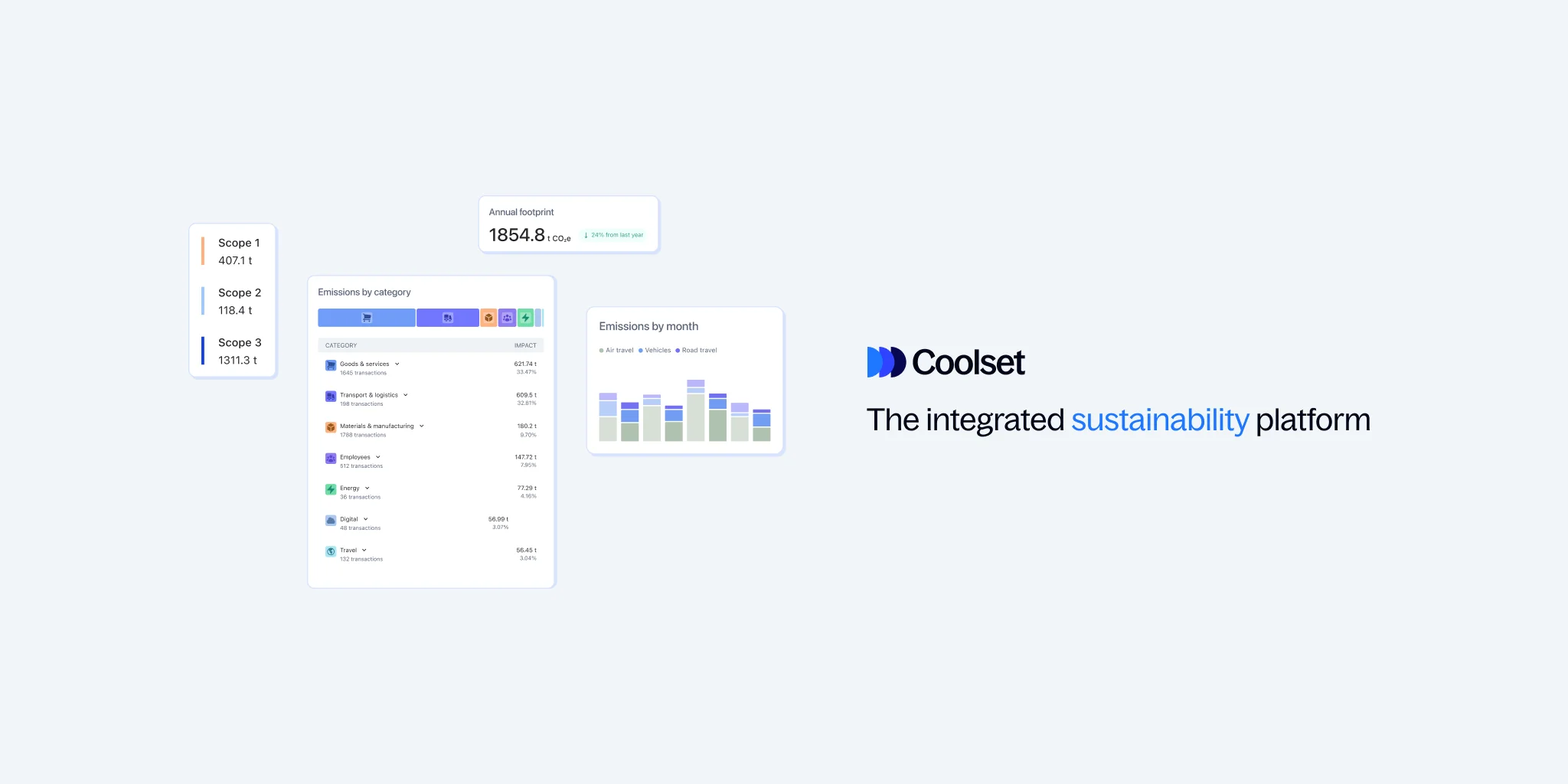

In short: We help companies gain emission insights with minimal human input by leveraging machine learning. The companies that use Coolset's software measure, analyse and reduce their emissions throughout their business and portfolio. In addition, Coolset offers industry benchmarks and emission offsetting solutions for companies to neutralize their climate impact.

Over the last couple of years, discussions on climate change have been receiving more attention. There is an increasing pressure from governments, investors, businesses and consumers to track, report and cut CO₂ emissions. The European Union is committed to achieve net zero by 2050. For companies, in order to achieve net zero emissions by 2050, all GHG emissions will have to be counterbalanced by carbon sequestration. In May 2020, the European Commission presented the EU Taxonomy for sustainable activities. This tool sets requirements for companies to be considered sustainable.

From a business perspective, this is extremely relevant as new legislation is introduced that mandates transparency from companies. To give an idea of the extent of data collection companies will be required to go through, the Netherlands has introduced impactful measures that will apply from 2023 to all Dutch employers with 100+ employees. These companies must start reporting the CO₂ emissions of work-related traffic of employees. Inevitably, this will result in additional administrative burden in the coming years.

Furthermore, key stakeholders and investors demand sustainability reporting from their partners and portfolio companies. Traditionally, ESG (Environmental, Social and Governance) issues have been a secondary concern to investors. However, this view is outdated. In 2019, Robert G. Eccles and Svetlana Klimenko from the Harvard Business Review interviewed 70 senior executives at 43 of the largest global investing firms. They found that ESG had become significantly important to these executives. As a result, more steps are being taken to integrate sustainability issues into investing criteria and corporate leaders will be increasingly held accountable for ESG performance. In the financial markets, shareholder activism is on the rise, with a leading topic of climate change.

At the end, our actions are more relevant than ever to curb climate change and its devastating consequences, which have been more tangible than ever in 2021. We’re positively looking ahead at a year of progress and making tangible impact that matters.

Thanks for making it down here. From now on, you can expect weekly curated content in our all new Coolset Academy. We will discuss hot environmental topics, publish notable climate news, introduce you to new technology and get you up to speed on market developments. Want to stay in the loop? Sign up for our newsletter below.

Get the latest updates on events, guides, market trends and product advancements.

Streamline sustainability measurements, improvements and compliance in one place.